Can you even imagine how happy putin is with his bitch?

I am starting to think about that Trump just learned what a tariff is during this election cycle. Still has no idea how they work, what their purpose is, when they should be used, nor how they impact local and global economies but, gosh darn it, if he isn’t excited to show off his new knowledge.

Maybe if they have him write out the word “TARRIF” on a piece of paper and put that paper on the white house fridge, he can be proud of it everyday and be able to move on to his next vocabulary word.

Remember, when he uses the “nobody knew this” that actually means he didn’t know it. And he says it a lot.

Because in his mind

He is the only person with any value

Everyone else is a lamb to the slaughter unless he finds them useful.

I don’t know about “with any value”. I think he just thinks he’s the only person. And the other people are…something else. Like people, but not.

It’s a less-educated concept of the “simulation theory” all the tech bros are into- “the universe is a simulation and I am why they are simulating it. Everyone else is an NPC.”

So, Main Character Syndrome?

Very much so.

Relearned, maybe?

He was also really big on putting tariffs on everything out of China in the 2016 election cycle.

Check out from 9:50, Trump has been talking about tariffs since the 80’s

It’s like he’s trying to kill the US dollar. Nobody who was actually trying to protect our currency would be making these moves.

It’s not a shocker why all the cryptobros are behind him either, because that’s their goal, too.

But I mean god damn it is really hard to exaggerate how stupid and easily manipulated Trump is.

Crypto Bros like him because they don’t want to have to pay taxes or to stop scamming people

No “like”, he is. Russia and China want to devalue the dollar and replace it as the world currency.

Obviously Russia is unlikely to achieve that, but I’m sure China encourages the use of RMB in their global operations, like in their belt and road projects.

They ironically don’t, they have so many controls in place it’s not even in the top five reserve currencies.

Russia benefits from a stronger US dollar insofar as its oil and gas exports are settled in that currency. The more valuable the US dollar is (as measured against the ruble), the more rubles Russia’s exports end up yielding — or the better they compete with other producers in international markets.

The fiat currency cannot be discussed in public. It’s mystery maintains it’s real value.

Are you advocating for the gold standard?

I don’t think that there is enough gold. Unfortunately.

Just use something else, like rocks.

TOO MANY rocks. It would be uncontrollable inflation.

So trump is going to start a trade war with the entire world now?

What is the next word after “great” when talking about economic depressions?

Depression bigly

Epic, grand, massive, fucked ?

Fantastic Depression :tm:

How about we keep “Great” and change Depression to Devastation?

Trump Depression

We have a winner

I was going to say epic, but that starts with an E. If we want the word after it should start with an H. ‘The Heavy Depression’? That way we can start to name them like hurricanes. The next could be ‘The Imploding Depression’, followed by ‘The Jumbo Depression’.

Huge. ‘The Huge Depression’

Nah, someone will kill him before that happens. You don’t fuck with the money.

The rich get richer from a depression. They’re orchestrating this dumpster fire with absolute glee.

Yup. They’ll bleed us dry and build a moat around their Hawaiian compound.

Looking at you, Zuck.

The Second American Civil War

Stupendous, I believe

Trumpian

deleted by creator

The bizarre Republican project of burning America to the ground, because they love it so gosh darn much, continues apace.

They falsely assume everyone else loves and covets it as much as they do.

For those with enough wealth, it’s a win-win. Either the dollar stays strong and you continue to trade assets/stocks/bonds accordingly, or it craters and you invest in cost-competitive labor on par with India and China.

In the latter case, while foreign goods are priced out of reach, a booming manufacturing sector will come in and “save the day” in states with poor worker protections/rights. The real magic trick is making sure you (the 1%) are in the room when the decisions are made to hold or fold before the general public knows anything about it.

Failure for USA is progress for humanity.

If a trading bloc abandons the USD, that means they are less interested in trading with the US. Slapping a tariff in them means that they will be even less interested.

If a trading bloc abandons the USD, that means they are less interested in trading with the US.

Not really. It could mean that they just want a just and fair trading system not ruled by a monopoly on green paper with slavers on it.

Are you seriously saying that the capitalists from BRICS countries are interested in justice, fairness, and cancelling slave owners as opposed to their own economic self interest while jostling for position with western capitalists about who should be higher in the pecking order of exploiting the global working class? Because if you’re serious about that, I would love to trade you some magic beans for your cow.

Why do I get the feeling Trump doesn’t know that tariffs can go higher than 100%? Nobody tell him.

I think in his head, 100% tariffs mean that other countries give the USA goods for free, or something like that.

No he’s thrown 2000% tariffs around at least once in the last few months. Fortunately for all involved he seems to have stopped doing that and switched to something a tiny bit less stupid.

The best tariffs ever

This either means the US economy will suffer … or America will fight back violently to force others to follow their rules

Either way, someone, or everyone is going to suffer

Por que no los dos?

I’ve said it before and I’ll say it again: the world needs a neutral reserve currency, not one issued and controlled by whatever country happens to be the dominant superpower.

I feel like this doesn’t solve much of the things you think it would.

Also, capitalists will never agree to this. They like having their own currencies cause they can manipulate them.

…capitalists will never agree to this.

I think this is the only way the capitalists can make their global, free market work. If the capitalists were smart, they’d want a neutral, global reserve currency. But, since most capitalists aren’t smart, it will probably never happen.

Who would issue it? What would it be backed by? Gold is globally valued due to its material value, but good luck getting your local coffee place to take it.

Congratulations, you’ve stumbled upon the one place where cryptobros would have a point if they weren’t mostly trying to make their “currencies” be investments rather than actual currencies.

deleted by creator

No.

It would have to be issued by some world central bank.

Money doesn’t need to be backed by anything, necessarily. Or, I guess you could say money is “backed” by all the goods and services available to purchase.

Not trying to be a prick; here for discussion. Wherrrree do we actually put central bank? I guess that maybe matters less than staffing the thing?? Obviously not an easy thing to do overnight but man we’d need to have like, serious cooperation and transparency to do that proper. Maybe not impossible though!

We’d want it to be in a neutral place, if at all possible. Perhaps a country would be willing to donate a small portion of their territory so an independent jurisdiction could be formed, not unlike Washington D.C.

For anything more than basic bartering, i.e. credit, it needs to be backed by an assurance that the fiat currency will be managed properly. Your basic loan is predicated on the trust that when you borrow $1000, the US won’t go and print another $1000 for shits and giggles and halve the value of what you get repaid. (I’m ignoring interest for simplicity here.)

For example, let’s say a car costs $30,000. I borrow that on a three year loan. But after one year, a maniac takes charge of the federal reserve and starts printing money. Now, since the value of the dollar has dropped, the same car costs $90k, but I’m still buying it at the original price. (Remember, the bank owns the car until I pay off the loan.)

For a real-world example, look at any hyperinflation scenario. When the unit value of a currency drops that fast, nobody wants to trade in that currency, because they would lose buying power.

This is why a currency has to be backed by a trustworthy body. Cryptocurrency is great, but if the operators have no consequences for manipulating it, then it’ll never replace traditional government-backed currency.

…it needs to be backed by an assurance that the fiat currency will be managed properly.

That’s the point of having a global central bank. They would manage it, and we would want to ensure that all appropriate mechanisms for oversight and accountability were in place. Transparency would also be of high importance.

Edit: I should point out that this is already somewhat in place. The US dollar, a fiat currency, is currently the world reserve currency, and it’s managed by the US federal reserve central bank. The problem is, the US federal reserve is the US central bank and it is not neutral, nor is it accountable to the rest of the world.

Gold. It used to be gold.

Just using the Euro would be a great improvement since it’s not based on a single country’s economy.

Indeed, I’d like to see my country, Australia, join the EU and trade the pacific peso in for the Euro. What a grand experiment!

You lads are already competing in the Eurovision Song Contest. So why not go all in and join the EU as well.

I wouldn’t base it on those rules considering Israel is also in Eurovision.

Doubt they want to join. Because then they have to recognize the ICC

Like it tracks, because they are European. But I’m not happy about it.

Israel is literally in Asia.

Israel is in Asia, Israelis are european

It would be best if there were a global union of nations, maybe one with the authority to oversee and manage global trade, as well.

We can barely get the EU to point in the same direction, good luck with that. Would be great though.

Yeah, it doesn’t seem likely.

Sounds like you want the gold standard back.

No, I don’t want that.

What is the difference between the gold standard and a neutral reserve currency?

A hypothetical neutral reserve currency would be a fiat-style monetary system. It would also require some kind of central bank and governance over it. It’s not impossible to achieve, but the politics around such a thing would be impressive to behold.

Also, I doubt the US would embrace either before seeing the dollar crash. It would take too much power away from the Federal Reserve, and by extension, global leverage.

The reason for fiat was to take the power of setting global monetary policy from people who had gold mines and give it to people who had big economies. At that time, it was the US because they didn’t fight WWII on their own soil, which was unique at the time.

Realistically, if the dollar crashes, it is in nobody’s interest to go to anything than the next biggest currency, likely the Euro. Except for the US of course, but what are they going to do about it? Start wars?

They will definitely do that.

*cough* BTC *cough*

OP said currency, not the post post-modern equivalent of an unregulated stock market.

It can be regulated if your country wants to do so.

Get with the times. Blackrock owns most of it.

Crypto can be controlled by the whales that own the majority.

Blackrock owns 2.366% which is actually less than what they own of USD wealth.

Switching to a “currency” that has never been stable and has a huge volatility problem? Sorry, I want that gallon of milk I bought in the supermarket to be roughly the same price when I need more next week than when I got it this week.

It’s very telling that most advocates of Bitcoin are very happy to volunteer how much money they’ve made investing in it. That’s not how currency is supposed to work.

To be fair, it is only volatile because you view it from the perspective of something you feel is stable (perhaps USD). If you instead viewed other currencies from the view of, let’s say, bitcoin then the other currencies would be fluctuating wildly. It’s a bit like Alabama and time: it’s all relative.

I’m viewing it from the perspective of a regular consumer. That’s really all that matters to most people. That if milk costs about $3 last week, it will cost around the same amount this week. Changes will come, but come slowly.

I’ve seen USD go up and down 30% compared to other “stable currencies”. Stability of BTC would come from adoption from a larger number of people, after the initial price spike caused by increasing demand.

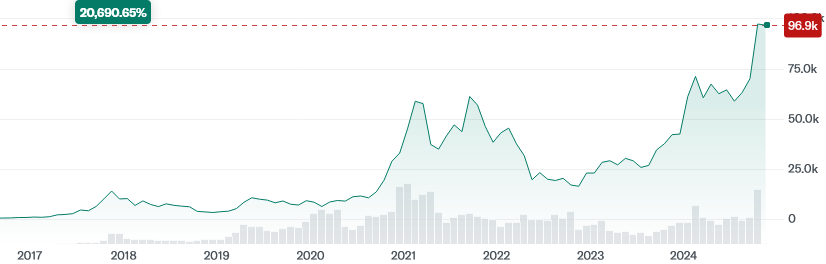

I bought some in 2023 for 30k and sold it for 60k over a year later. Right now it’s worth 100k. I don’t think people should by at this high a price range, it’ll probably be much more affordable in a year and spike again later before and after the halvening.

At some point it’ll be too big to pump or dump, and doing so is already highly illegal in many countries. There’s basically no risk of a person buying in and having it decline to never recover.

Yes, the dollar is, as all currencies are incredibly volatile in times of crisis. No shit.

Bitcoin has, as I said, never been stable. It’s not even designed to be stable. Week over week, in general economic times, the dollar has the same value. You simply cannot say the same about Bitcoin. Again, this is why most advocates of Bitcoin are happy to volunteer how much money they’ve made investing in it.

Unless you are a high-end currencies trader, people generally don’t talk about how much richer they are in Euros this week than they were last week. Because that’s not how currencies are supposed to work.

Cool meme and all, but the fact that you yourself are talking about when someone should or shouldn’t invest in bitcoin just proves my point. That’s the opposite of stability. People don’t regularly move their savings from dollars to euros and back depending on which is worth more.

Good for you for getting rich on your investment opportunity though. I’m sure that’s very nice for you.

You couldn’t find the point if it was layed out cleanly before you, as I clearly explained it is not currently what it very easily could become, and also that it is virtually no long term risk even in its current state.

Tariffs will further devalue the dollar.

To the contrary: the value of the US dollar, as measured against other currencies, has surged in the past weeks amidst Donald Trump’s announcements of tariffs, because markets expect them to bump prices and higher prices, in turn,

wouldcould prompt the Federal Reserve to raise interest rates, just as we saw in 2022.TL;DR: higher tariffs => higher prices => Federal Reaerve raises interest rates => US dollar appreciates

The incoming Trump administration could counter this dynamic by changing the mandate under which the Federal Reserve has been operating for about a century and bringing it under the executive, stripping it of its independence.

Reality TL;DR: Fed is not actually raising interest rates any time soon.

It’s been great for crypto and not much has even happened yet.

Guys don’t you see how much the economy will grow?

If it drops 50% it will be a 100% growth once it’s back where it was. That’s like stable genius!

/s

"If you don’t listen to me I’ll… "

checks notes

“…tax my citizens even more!”

Me 6 months ago: “Well at least inflation isn’t as bad as it was in the Weimar Republic…” Me now: “uh oh”

BRICS, Canada and Mexico should be making a trade treaty right now, before Trump even takes office.

Considering R in BRICS stands for russia, no, they certainly shouldn’t.

I don’t know if you noticed, but the B stands for Brazil and those 2 countries aren’t exactly buddy-buddy. Treaties are more than their constituent members.

Yeah I’m surprised to see India and China in it together as well.

Doesn’t surprise me, only if you buy into everything America and the west tells you

They do have ongoing border disputes with skirmishes and fatalities.

What the US wants and what’s good for other countries are not the same things.

But I am European, anything that breaches sanctions against putins russia isn’t good for me either.

Russia wouldn’t really matter in the equation. China, Brazil, Mexico, Canada would be the main players. They don’t like each other, and have some serious diplomatic issues of their own, but could easily agree to stand together in self interest. Pulling in any other major US trading partners would also help all of them.