- cross-posted to:

- economics@lemmy.ml

- bitcoin@lemmy.ml

- cross-posted to:

- economics@lemmy.ml

- bitcoin@lemmy.ml

It’s a presidential election year; time for every single Republican to suddenly start talking about a “debt crisis” that for some reason didn’t exist while they were running up record deficits to cut taxes for the wealthy.

Not just cut taxes for the wealthy but hand out $2T in cash to wealthy people/companies while us regular people collected the falling pocket change.

It doesn’t change the fact that the US has an unsustainable growth in the national debt which continues every year. Broken clock right twice a day etc. The US spending more than it makes on a consistent basis is not good long-term. It’s a bipartisan issue, both parties regularly approve budgets well above what we can afford.

Jerome Powell is the fed chair, he was nominated to the post by President Barack Obama in 2012, he was subsequently elevated to chairman by President Donald Trump (succeeding Janet Yellen), and renominated to the position by President Joe Biden.

Cool, why doesn’t he talk about eliminating the carried interest tax dodge for the wealthy?

Because he’s being paid not to

He’s also a bureaucrat, not an elected official who can change the tax laws. He literally has no standing when it comes to making laws.

He could certainly make a suggestion. Congress is the one that has us on an unsustainable path and he has no problem pointing that out; so why not a solution?

And elected officials would have a fit if he did, 'cause it’d be crossing into their legal territory.

The US spending more than it makes

The national economy of a global imperial power doesn’t follow the same rules as your friend who’s always broke a few days before pay day.

Talking about one like it’s the other is either proof of ignorance or an obvious attempt to deceive.

You’re right. We can spend more than we make forever. There will be no consequences to such a fiscal plan. Don’t listen to Jerome Powell, he doesn’t know what he’s talking about.

National debt is not the same thing as spending more than you make.

Have you taken an economics class before?

How is it the federal debt and the public debt are perfectly aligned in that chart? Are those labels wrong? Am I missing something? Seems sus…

I believe this is where it’s from. If you look up similar charts you’ll see similar data. Most debt is publicly owned in the form of bonds, treasury notes, etc https://econofact.org/why-is-the-u-s-debt-expected-to-keep-growing

Short answer, I misunderstood. “Debt held by the public” sounds like my credit card debt, but it’s not. That is (obvious now) private debt.

https://www.crfb.org/papers/qa-gross-debt-versus-debt-held-public

https://research.stlouisfed.org/publications/page1-econ/2020/03/02/making-sense-of-private-debt

So… anyone have a transcript? Because I don’t want to watch the whole video to find out that he never suggested raising taxes on the wealthy or raising the minimum wage. Especially when he probably never suggested either.

OP is a cryptocurrency bait-and-switch poster. They make these posts and then reply to comments with crypto shilling.

They really suck at it.

Jesus you weren’t kidding

Thank you.

Well what do you know-

That saved me a lot of time. I appreciate the link.

Glad to help. :)

Sweet, reverse the permanent Trump tax cuts passed in 2017.

Catastrophe averted!

https://realprogressives.org/debt-ceilings-for-dummies/

Just gonna drop this here to try and spread some knowledge.

Going to leave this here to add to the questions we should be asking …

Waddaya mean? The Fed said we had unlimited money to print!

Oh, it’s an election year. Gotta keep those mathless idiots gaslit.

Hmm maybe giving centralized authorities the ability to print money whenever they want wasn’t a great plan.

Maybe giving centralized entities control over our currency and the ability to print money whenever they want wasn’t a great idea. Here’s to your USD being worth even less in 10 years due to an increase in supply. The official monetary policy of the US Govt is to aim for 2-3% inflation every year 🥂.

Bitcoin, with its fixed supply and decentralized production solves this.

- The ability to transact for everybody on the planet with access to a cell phone and a halfway reliable internet connection. Including the billions of people who no access to stable banking infrastructure “the unbanked”.

- Bitcoin has a clear economic policy: There are 21 million BTC total, no more will ever be printed.

- With Bitcoin lighting, transactions settle in under a second and cost pennies in fees.

- It has functioned 365 days a year, 24 hours a day without a single hack, bank holiday, or hour of downtime for 15 years.

- A market cap of 850 billion, in the top 25 countries by GDP, higher than Sweden, Vietnam, or Israel. Consistent growth in adoption year after year no matter how you measure it. Big banks and hedge funds invest in it because its simply better currency, they see that it is useful.

- And it does this for <1% of global energy usage, mostly from renewables.

Bitcoin, with its fixed supply and decentralized production solves this.

Gotta love it. A Bitcoin ancap on lemmy.ml.

Seems like confusion is his preference state.

Lol Bitcoin…

Bitcoin is deflationary because there is a fixed amount of currency. But wealth isnt fixed, new wealth can be generated(or destroyed). And you want a currency that can adapt to that, otherwise you get a deflation(or inflation).

For example, i buy wood for 1 bitcoin. I make a chair that i want to sell for 2 bicoins(to compensate for my work). Thus i changed something that was worth 1bitcoin, into something that is now worth 2bitcoins(or at least 1+ bitcoin).

In a world where no new money can be created, money will just rise in value over time. Why? Because new wealth is created but no new money is generated. So current money can buy more things(since more things are generated over time).

But if 1 bitcoin can buy more things tomorrow than it can buy today, why would i spend it? I wouldnt. Thus i will be removing currency from the circulation(essentially hiding it under my matress). Which creates even more deflation and deflation is literally the worst thing it can happen in the universe.

Deflation discourages purchases and discourages investment. Why would i spend 1 bitcoin to buy wood to make a chair, when i can just save that 1 bitcoin under my mattress and get a chair with it in the future(since its value will rise).

The only people who support these things are economically illiterate people. There is a reason why there are almost no modern economist who are proponents of gold. It isnt because they are all sold out to governments, who just want to print endless money. It is because printing money is necessary for an economy.

The when and how money should be printed differs depending on the school but they all agree on this.

One of the main reasons that we abandoned gold as a currency was because rich people kept hording it, which meant that it was removed out of circulation. So you literally didnt have enough currency for the economy to function. Money is not a thing, it is a medium of commerce.

Also modern day production enables us to generate wealth orders of magnitude faster. Industrial revolution and the internet means that even if metal based economies could somewhat work in the past(due to mining), modern day economies have a much larger need for a fiat currency.

But if 1 bitcoin can buy more things tomorrow than it can buy today, why would i spend it?

Simple: because you want something. Have you ever bought a computer? Why? Because if you waited a year, you could get a computer with double the performance for the same amount of money. Your money would buy more tomorrow, yet you spend it today.

Deflation discouraging purchasing is not necessarily a bad thing. It means products need to be better, all else being equal, to be purchased by you. Maybe that means they will last longer, be more sustainable, etc. We want people to buy things because they need or want them, not because they want to get rid of currency as quickly as possible because they know it’s losing value. Production for production’s sake is pointless. It’s like government paying workers to build a road to nowhere (as China has been doing with their rail). Does it pump your GDP numbers? Yes. Does it make jobs? Yes. Does it make your economy look like it’s growing? Yes. Is it a waste of earth’s resources and government money? Yes. Is it sustainable fiscally or environmentally? No.

One of the main reasons that we abandoned gold as a currency was because rich people kept hording it, which meant that it was removed out of circulation. So you literally didn’t have enough currency for the economy to function. Money is not a thing, it is a medium of commerce.

If you are talking about why we moved from gold to paper money: It was also a major pain to transact with compared to paper money, I would argue that was the driving factor for abandonment. Rich people hoard money now too, they just put it into assets and securities and generate a return, then live off the interest. We have massive growing wealth inequality. So it’s not like fiat solved that problem. I’m not saying Bitcoin would, I’m just saying we didn’t solve the people hoarding gold problem. People can still hoard gold and other assets.

If you are talking about why we moved away from the gold standard, yes there being a limited supply was a problem. We pegged a dollar to a certain amount of gold and pretty soon we ran out of gold to buy to maintain that peg. The government wanted to print money it couldn’t find gold to back. It wanted to fund things it didn’t have money for. That’s a money printing & budgeting problem, not a gold problem. That’s a spending more than you have or make problem.

Money do not exist as wealth, they exist to be used as a medium for transactions. They are a representation of wealth but they are not wealth. Their only function is the get circulated. You are seeing things pretty narrowly. Let’s say you have 10million. You have the option to keep them under the mattress and they will worth 50% more in 1 year. Or you can invest them into something.

What would you choose? Why would you risk investing that money into something when you can guarantee increasing their value by keeping them? Now imagine if everyone is doing that. Everyone is taking out of circulation trillions of dollars because it is more profitable and less risky for the future.

What effect would that have in the economy, quality of life, technological progress, literally on everything? And this is why deflation is orders of magnitude worse than inflation.

Production for production’s sake is pointless.

Almost all production is for production’s sake. Humans need nothing to survive. You can become a hermit and consume nothing. Yet here you are, being inauthentic and buying things that you ultimately do not need for survival. Clothes, coffee, phone, haircut. Even your diet is not maximized for calories needed.

People adapt. Thats how someone can live in extreme poverty with less than 2 dollars a day. Think that next time you buy a 5 dollar coffee. You could have fed 2 people for a day.

If you are talking about why we moved away from the gold standard, yes there being a limited supply was a problem. We pegged a dollar to a certain amount of gold and pretty soon we ran out of gold to buy to maintain that peg

You should read more about the history of gold. We created silver coins because we run out of gold because the rich people hoarded all the gold and did not use it because by not using it, its value kept increasing. So we got the silver coins but then the rich kept hoarding them too. So we made fiat(or their era equivalent).

Bitcoin is not a good currency. The fundamental use of a currency, the whole point of its existence is to be used. Bitcoin is heavily throttled by design and cant be used as an every day currency. No crypto can replace VISA without become centralized and VISA like(which defeats the point of crypto).

I have been following crypto for 10+ years. It is a cool tech(decentralized database) but everything related is a “scam”. Even if it isnt a deliberate scam, it is still part of pump and dump and an unusable speculative asset. All volume is whitewashing and gambling addicts. Crypto has basically 0 real world use atm, lower than the use it had 5 years ago. Noone cares about adoption anymore, i wonder why.

Yet the market is up. That should tell you everything you need to know about crypto. It’s value is not representative of real world use. Not to mention that the whole point of crypto was decentralization and not having a middleman but most people keep their crypto in exchanges. Crypto dudes are literally reinventing the conventional economic system, with fiat and banks. What do you think the whole layer 2 stuff is? It would be hilarious if it wasnt so sad.

Exchanges are literally banks and your account there is literally FIAT. Not your keys, not your money. Your money is just a number in an exchange spreadsheet. And could disappear tomorrow, just like it has happened many times so far(every time an exchange goes bust).

Most people still keep their money on an exchange because ultimately it isnt about the crypto technology, it is about gambling and get rich quick schemes.

Rich people hoard money now too, they just put it into assets and securities and generate a return, then live off the interest.

True but at still in theory, the central bank can nuke their monetary wealth. So they are forced to use it. Buying assets is vastly preferable to keeping the money under the mattress. Again, it is all about circulating the currency, thats its main purpose. This is not a bug, this is a feature of the currency. You arent supposed to hoard it.

Money is a transaction tool. Money is not wealth, it is just used to represent wealth as a convenience. Hoarding money should not be your goal, your goal is to use that money to acquire things, either things that you “need” or “investments”.

That’s a money printing & budgeting problem, not a gold problem. That’s a spending more than you have or make problem.

Again, you assume money is wealth. But even if you think it is the evil governments who want to have infinite money, ask yourself, why literally no economist supports the return to gold. Economists are the most contentious breed of people. They disagree on everything. Why do they agree on this?

It’s been awhile since I saw a cryptobro in the wild. I have to assume you’re a very low effort troll.

I put a lot of effort into it

Oh man, you really don’t know what you’re talking about AT ALL do you? You’re missing some crazy basic economic concepts.

Here’s to your USD being worth even less in 10 years due to an increase in supply.

The last time US Federal Reserve “printed money” to create more USD to decrease the value was March 2020 during the pandemic. The real term for this is “Quantitative Easing”. source

So not only is it NOT every year that new money is “printed”, the US Federal Reserve also does the opposite and removes that printed money reversing the value drop resulting in an increase in the value of your dollar. This is called “Quantitative Tightening”, and guess what? US Federal Reserve last started doing Quantitative Tightening most recently June 2022 and has kept doing it since then and is still doing it right now as we speak. Analysts are guessing the US Federal Reserve will likely stop doing this sometime in late 2024 or 2025 source

You know in the US government is authorizing all of this? The same person in your original OP link: Fed Chair Jerome Powell

The official monetary policy of the US Govt is to aim for 2-3% inflation every year 🥂.

Damn right! You know whats worse that 2-3% inflation? Every other scenario.

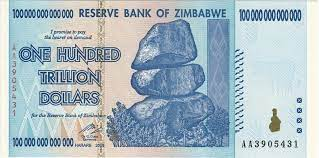

- Deflation: Where your money is worth more tomorrow than it is today. Everyone stops spending. Economy grinds to a halt.

- Stagflation: Where there is very high inflation (which would normally be an indicator of a hot economy) but the economy is slowing to a crawl

- Hyper inflation (inflation at 50% or higher): Where your paycheck and the end of week is only worth a small fraction of what it was when the week started. You get countries printing money like this:

At the end it was nearly worthless too.

Seriously, read a basic Economics 101 book. All this stuff and more is in there.

While bitcoin allows us to control monetary policy the one chosen for BTC was a big mistake. The fixed supply benefits early adopters very strongly which just creates a new different financial elite and just doesn’t make sense when you consider future generations.

I’ve switched entirely to being interested in Ergon which is a code fork of Bitcoin but with block reward proportional to difficulty which means coins are mined with a fixed electricity cost and so instead of pumping and crashing the price is pushed towards an equilibrium of the production cost.