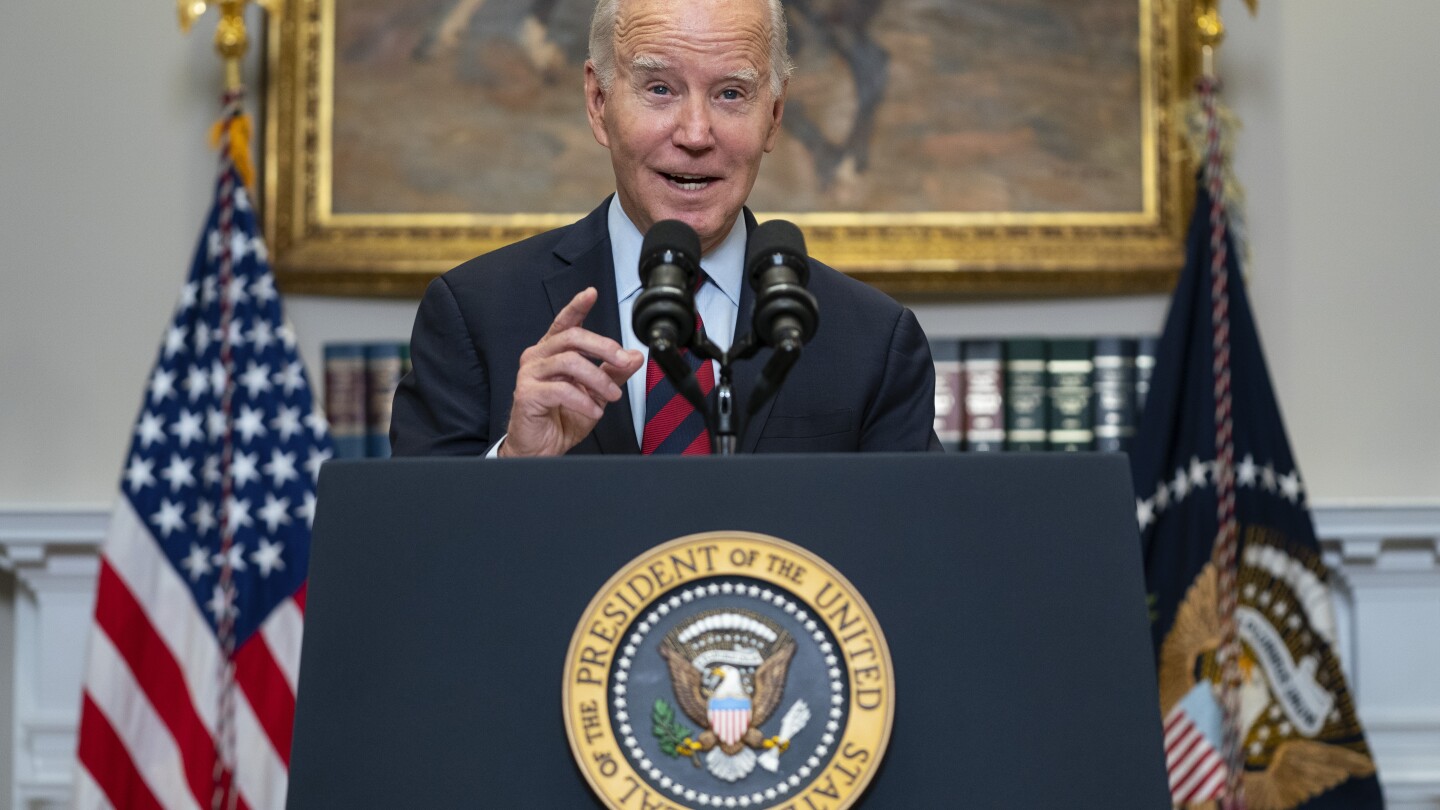

Americans who are struggling to repay federal student loans because of financial hardship could get some of their debt canceled under President Joe Biden’s latest proposal for widespread loan forgiveness.

Several categories of borrowers would be eligible for relief under Biden’s second try at widespread cancellation after the Supreme Court rejected his first plan last year. Those with older loans or large sums of interest are being targeted for relief, for example. On Thursday, the Education Department expanded its proposal to include those who face financial hardship.

The plan was expanded amid pressure from advocates and Democrats who said the proposal didn’t do enough for struggling borrowers who don’t fit into one of the other cancellation categories.

is the definition of hardship static or is it scaling?

It’s going to have to be defined as “as much as they think they can do without having to go through congress.” Since nothing gets through congress these days.

Definition is somewhat vague still, the draft text is here:

https://www2.ed.gov/policy/highered/reg/hearulemaking/2023/student-loan-debt-relief-proposed-regulatory-text-section-30-91-hardship-session-4-v-1.pdf

Likely vague on purpose so the secretary of education can be flexible in setting the exact terms.

There 17 different potential factors for hardship listed that could be considered, including “other.”

Sounds like they should at the very least allow it to be discharged in bankruptcy. As that’s exactly what desperate people to with untenable debt. But hopefully this accounts for the majority of people who simply can’t afford to ever repay their loans.

Guess who made it so student loans dont get discharged in bankruptcy

https://www.theguardian.com/us-news/2019/dec/02/joe-biden-student-loan-debt-2005-act-2020

It’s correlated to the White House’s evolution of the terms inflation and recession