I wonder what the stats look like for profit rather than revenue. A digital company like Google should have higher margins than a product company.

Last I checked Microsquash was clearing 22 Billion per quarter in profit

Microsquash?

At a guess, it’s probably a mocking name for Microsoft.

There are ~100k feral humans sent back to live in nature within 100 miles of me in the greater Los Angeles region.

Go on, I’m listening.

Makes sense, people use the alphabet every day. Don’t understand why more people don’t just pirate letters though.

N̴̨͕̰̲͈͊͑̅̀́̉͗̎̿͌̾́̈́̚͜ò̴̱͎͇͗͘ ̵̛̫͚̱͈̫r̴̢̢̹̼̻͖̪͉̯̥̮̩̒ę̵̺͉̤͖̱̣̰̗̆̊̽̂̿͌á̷̤͖͈̔̒́͛͆ṡ̵̛͓̹̼͖̦͉̭̦͇͉̳̉̇́̅͊̂͗̅̃̈́̅̔̕͜o̴̳̫͍̼͇̥̖̣̓̄̉͗͊̀̆̏̎̔̌͝n̷͇͉̥̰͍͇̟̒̀̅́̃̈́̈́̈̂́̄̄͘

01000111 01100101 01110100 00100000 01101111 01110101 01110100

It would be more or alternatively insightful to have the profits rather than revenue

I’d really like to see both. Actually a ratio of time it takes to earn that much profit vs that much revenue is a likely a great indicator of just how “evil” a company is. Costco is likely the least evil on that list based on that ratio.

Ya, revenue/profit would be insightful

I dunno, I feel like it makes more sense to have the revenue. Just how much they’re bringing in is more interesting, that’s how much money is coming into the accounts, y’know? Expenditures vary so widely between industries, this i feel is generally more insightful.

True. We await your updated infographic with bated breath.

You left Amazon off, but they earn a billion dollars in profit every day.

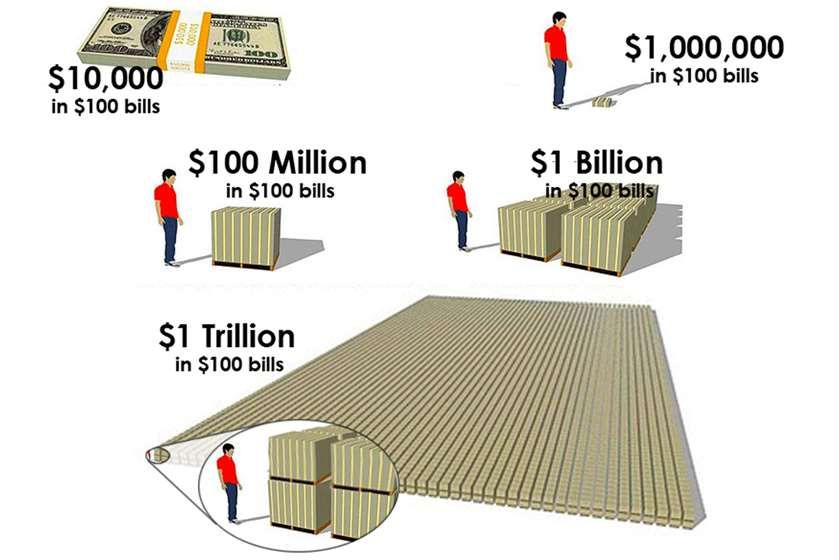

That’s ONE THOUSAND MILLIONS.

I feel like we need to put a billion in perspective more often.

How far is a million from a billion? About a billion

that’s a good way of putting it

I always liked this one.

It took me way longer than it should to remember that Caterpillar doesn’t refer to some random ass creepy crawler on a tree

In the meantime, the one entity that enables them all to hit these numbers: over 400 years.

spoiler

Apache foundation of course

WTF? Invidia has half the revenue of Wal*Mart?!

Walmart is buying crap from other companies.

Revenue, not profit. So every dollar incoming, regardless of dollars outgoing. Usually not exactly that simple, but on average it’s just that.

That is what I am saying. When Walmart sells a grill the total price the grill is revenue. Even though most of that will end up going to the grill company.

It is mind blowing that Invidia even compares to that.

Nvidia is cashing in very very well on the AI bubble at the moment. It’s unsustainable of course but yeah

Distribution, when scaled becomes a monopoly. Walmart does not buy products like you are implying. Walmart is primarily a consolidation of both distribution and retail. They set their own margin requirements. The grill maker is not selling their products for Walmart to retail. The grill maker is doing everything they can to get a product into Walmart because Walmart is the gatekeeper. It becomes a situation where, I can sell 5k grills world wide per year to a niche market online or with the biggest independent distributors I can find. I can run a small 10 person business on that business model, but I need keystone margins (50%) and a retail price of $600 to break even, and $800 to be sustainable long term. Walmart wants me to make 100k grills at a price of $350. Because of the scale I can stop thinking about margin and start thinking in terms of cash flow. The scale allows me to make just under $100 per unit sold, and after doing the math, I can grow my business substantially.

Walmart doesn’t approach me per say, I approach them and pitch my product because I know their requirements, and if they choose my product, it is a major growth opportunity.

Decades down the line, no one can get their stuff into a Walmart because it takes massive capital to compete within the ecosphere. You can’t start a business with a million dollars and create the economy of scale needed to meet Walmart’s margin requirements. This is why that niche product elsewhere costs so much more. Walmart, like all other big box stores, is like retail authoritarianism, it takes away the democratic opportunities of the average person and creates a financial dependency with a inflationary monetary control scheme. Eventually, most people are dependant on the lower price goods and have no effective choice. While at the same time, the choice of Walmart prevents them from creating innovative small businesses and products at a grass roots level, stiflingly social mobility as a major gatekeeper for class disparity.

Exxon is the one company listed in there that enables all the rest of them to exist.

Now do truth social!