Answer: Informal Market.

When it comes to income and taxation, there is a lot more grey than you think.

Technically, ALL income for business-earning purposes should be reported and taxed accordingly.

Regarding taxation of the buyer, at least in Canada, GST is generally not applicable until the seller is earning $30K+.

But REALISTICALLY - no taxation agency really cares about 1 chair.

I probably wouldn’t consider it a black market/underground economy unless it was significant and ongoing. E.g., your neighbours REGULARLY sell chairs for profit and don’t report their earnings.

This is like how buying and selling Bitcoin was no big deal until people started making significant money. Now the US income tax forms include direct questions about whether you have income from cryptocurrency.

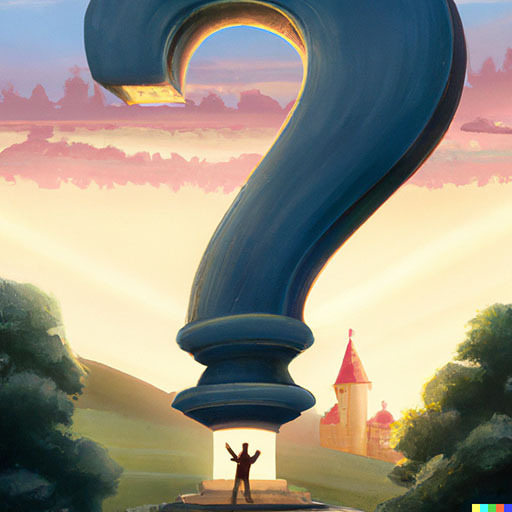

I don’t know the official term for the kind of market…

In Canada in most provinces you don’t have to collect tax and you aren’t required to have a registered GST/HST number until you collect 30k CAD a year Some province have Provincial Sales Tax charged separately, in which case either a different minimum may apply ($10 000 in MB, BC) or there is no minimum (such as in Saskatchewan).

It also depends if they are selling it for profit or if they are just selling something they no longer need.

I’m not a lawyer but maybe grey market?

Informal Market.

Neighborly market?