- cross-posted to:

- news@beehaw.org

- cross-posted to:

- news@beehaw.org

To someone from Europe like me, the US very much feels like a dystopian hellhole whenever I read stories like these. How can a government hate its people so much?

To somebody trapped in the U.S., it feels like a dystopian hellhole from in here as well.

deleted by creator

I guess I’m glad I have dual citizenship but jfc, my parents brought us here because it was supposed to be better lol.

It is a viscous loop where the ppl are told to hate their gov so they elect Republicans who want to dismantle it. The Republicans do and then gov sucks so ppl hate it more.

Rinse and repeat.

And this isn’t even a theoretical or metaphoric description.

We have candidates now already laying out plans for massive workforce reduction in the already overworked, short staffed federal government, which will make them even less productive, which will prompt these people to point out that lowered productivity as evidence for why they should take even more resources away.

They’re literally pushing to eliminate jobs, not create jobs, and to bring unemployment to veterans (who are a big demographic in the federal workforce).

The same people who set up public education to be measured on standardized testing, in which your students falling short on their test scores means your funding gets cut, not increased.

Most people here are brain dead idiots that don’t know that a politician’s job is to create policy. They think it’s a team sport and if you cheer louder for your guy, they’ll punch the other guy in the nuts. This is why we don’t have nice things like attractive cities, public transportation that actually works, or actual culture.

Like all corrupt governments in the world, they care about making money and not paying taxes. They don’t care about other people.

deleted by creator

Only shitty if you don’t have money. If your are in the top half it’s fantastic.

Half??

Top half of the median salary is 95k a year. Nearly all of them will have decent health care. They’d be making less than in Europe in many cases and that includes cost of healthcare.

I’m not saying we shouldn’t improve, especially for low earners, but much of this country is very well off compared to our European counterparts.

Where are you getting that number? BLS shows median male income per week at ~1200 which is not 95k a year

much of this country is very well off compared to our European counterparts.

I may be wrong, but you don’t sounds like you’ve spent much time in Europe.

I spent many months in Europe. From Spain to Kosovo and pretty much every where in-between

As if any of that matters at all in the least bit because your complaint is just a massive strawman but I’ve been all over including the pesky countries you all like to forget even comparing quality of life in the States.

Not a straw man. Personal experience. I’ve spent most of my life in Europe, in several different countries. And spent more than a decade in the US.

I can comfortably say that most Europeans, especially those in the middle and on the lower end of the income scale live vastly more comfortable lives than most Americans with similar incomes without having to worry about medical bankruptcy and crushing student debt. Not to mention having the time off to travel and parental leave to form families without all the financial stress Americans experience.

I make about 45k and my SO half that but we have no kids and I just wish I could retire. I’m almost 40 and just tired lol.

Top 20% maybe

I’d agree to have a conversation on the details. It’s nuanced. But the median salary in us is 90k. That’s enough to live comfortably compared to most of the world.

Median salary in the US according to the BLS is slightly over $50k

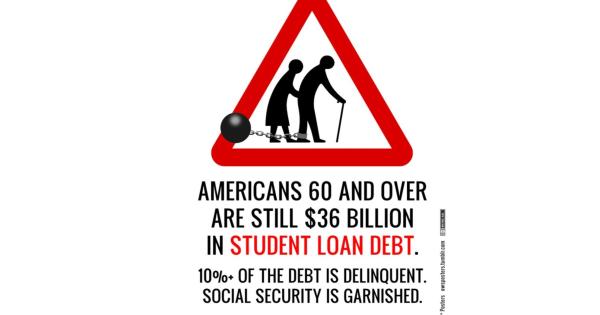

Dear God this is saddening to read. What just system saddles people with a debt they have no choice but to take on in order to hopefully get a decent enough education to repay the loan, but then fails to account for situations where the borrower’s income is not sufficient to be able to afford more than the minimum payments? All the while applying compounding interest on the principal to make sure it’ll never be repaid?

And to make it truly evil, makes it so that they can garnish both your wages and pension in case of a default?

Seriously, student loans and medical debt should both be interest free and prorated to the person’s income in terms of minimum payments. It’s ridiculous to force people into a life of debt slavery just for the shot at a decent education or the right to be healthy.

It’s ridiculous to force people into a life of debt slavery just for the shot at a decent education or the right to be healthy.

You have been banned from c/Conservative.

Please don’t tell me that exists.

I take that as a badge of honour.

In my opinion health care should be free. But I am just European

College should be free too. An educated populace improves the economy, as does a healthy one.

But an educated populace could ask questions…

Wr forgive you 😭

At least medical debt can be discharged through bankruptcy. You can’t even escape from student loans by going bankrupt.

Which is probably the most ridiculous thing ever. Bankruptcy should treat all debtors equally, and we should treat personal bankruptcy similar to corporate bankruptcy. Instead of creating classes of debt that survive a bankruptcy by default, how about we just include them all into the debt restructuring process? Figure out what the person can and can’t pay and make a plan based on that? It just feels exploitative to make some debts exempt from having to do that.

My theory: not only your points, but also, it’s Because it will one day affect inheritance… when a parent dies and has this debt, their assets will cover it, the medical debt and credit debt… with school loans on top of the pay back, the inheritance amount will be way lower, keeping the cycle of people staying poor and desperate… to keep low income people, low income…

parents from the 70-90s who bought houses also had school debt and when they die, and leave the house, their assets will first go to their medical debt, school loans, and other debts they had. Why? To keep the cycle of low income people which no chance of owning a home, desperate, poor and in a perpetual cycle.

Man, that’s even more depressing. I will never understand why (mostly conservative) governments try to keep people down like this. I thought the human experiment was about lifting people up out of poverty and misery, not invent arbitrary systems that keep them there. What does society stand to gain from creating effectively a class of outcasts at the bottom of the social ladder?

Cheap labor to further enrich the upper class.

If they are merely surviving then they wont have the resources to fight it.

But at some point the upper class depends on more than just cheap labor. You need educated people to innovate, you need a well-paid middle class to support a consumption economy. If everyone is uneducated and destitute the whole house of cards upon which the upper class is able to exist will collapse.

I just don’t understand how the concept of “a rising tide lifts all boats” is so lost on some policy makers.

The issue is youre trying to address this with care and empathy and logic.

Youll never understand if you dont think like a sociopath, people can be replaced, it’s about having more, future be damned we need to maximize the now, and if people die then they die.

But at some point

The above statement is what they don’t understand. They don’t see more than three months ahead. All of the “eventually” is in a fantasy land that they won’t reach called “next quarter”.

You have a choice to not take student loans or take an amount you can pay back. Many to most people actually do this.

For many the choice to not take loans mean they cannot go to school at all. For some reason, even the most mundane and menial office job requires a college degree. This means for a lot of people they are effectively stuck working minimum wage.

Student loans are only a part of our broken system. But its one that unfortunately is forced upon many people if they want to make a living wage.

That was me in 1996. My parents worked in factories when I was in elementary school, getting paid a piece rate for work. By the time I graduated from high school, their factory jobs had been sent overseas or to Mexico, and they were working as a handyman & selling shoes at Walmart. Combined, they made somewhere in the low to mid $30k per year range, and had 3 boys to raise. I had to take loans to go to college. I worked as much as I could to try and cover my bills while in college. I had the GI Bill from the national guard providing a couple hundred dollars per month.

I ended up dropping out of college after a few years because I couldn’t keep up. I went back after my daughter was born, and used the max federal Stafford loans (~10k/yr) to help pay living expenses because I was working 2-3 part time jobs to work around my schedule and helping to pay rent, utilities, and food for myself, my wife, and a baby while my wife went to school as well. I worked so much that I barely remember my kid before she was in 2nd or 3rd grade. I don’t think I could have worked more.

But now, conservatives say that I shouldn’t have taken loans. I shouldn’t have gone to school because I couldn’t afford it. What is the alternative? A life of raising a family making minimum wage delivering pizzas? Relying on public assistance and tax credits? Or working my ass off for a few years, taking some loans, paying them back slowly with maybe some forgiveness at some point, and now paying 13-15k per year in taxes?

Kind of weird to be told to “pull yourself up by your bootstraps”, do that, and then be told that you should have just stayed poor because your parents couldn’t afford to pay for college for you.

There are plenty of ways to go to college without significant loans. It often means not going to U of _ or _ state, you can easily save $20k+ over 4-5 years by just choosing a less expensive school. There’s need based scholarships, community colleges, tuition reimbursement plans, military service, academic scholarships, sports scholarships, and more. You do need a plan to get through in a reasonable time frame, just taking some classes and hoping to eventually wander into a degree is a recipe for crushing debt.

All of the things you mentioned require extra work from an individual that inevitably means others who don’t receive those things will be left without. No one should have to jump through those extra hoops and many just can’t for various reasons. And people should also be able to “wander into a degree”, lives and plans change. Sometimes people have to switch tracks or leave and return to college and there shouldn’t be repercussions for that.

Career planning is just about the biggest scam we’re sold when selecting an education.

Nobody, and I mean absolutely nobody, can predict what the job market will look like 5-10-15 years into the future, and yet we’re asking people to gamble in the casino of life to get an education and take on debt (even if you are going to a less expensive school - the person you’re replying to had parents working minimum wage, nobody in that situation has the kind of spare capital to fund any education without a loan) in hopes that their chosen profession will a) still exist when they leave university b) remain viable long enough to repay their debt and c) the economy doesn’t contract significantly while they are in school, resulting in a “lost generation”.

You need to have a seriously high powered crystal ball to make a prediction that accurate, or just admit that we’re effectively forcing kids to gamble with their futures.

Not just people, we are asking TEENAGERS to gamble on what they even like ornare interested in doing in 4+ years. These are kids!

And let’s not forget that the majority of college grads are not even working in the same field as their degree.

You don’t have to be a fortune teller to know a bachelor’s in psych is basically useless on it’s own, but no matter what you choose, getting in and out in 4-5 years is critical, 7+ years of even modest loans is going to crush you. That’s the bigger point.

That’s not the point I am trying to make. The point is that even those “common sense” judgements change over time, and even if you manage to get out in 5 years or less that career you picked based on common sense might be going through a recession, regression, is being replaced by foreign labor or technology, etc. etc.

Yes the employment market fluctuates, but it rarely dies. Lawyers probably had the worst of it recently, but very few majors end up with limited options rhat didn’t start that way. People that entered education knew the pay sucked well before they enrolled. Tech had layoffs at the beginning of the year, but places are already hiring again.

I’m not sure the statistics agree with your assessment of it being “many to most”. For many people there simply is no choice. You either take out a loan, or you’ll be stuck working minimum wage for the rest of your life. And even for those that do take on an amount of debt that seems reasonable based on their prospective career path - that’s still a BIG gamble that can spell financial ruination if, for whatever reason, said career fails to materialize.

https://www.aplu.org/our-work/4-policy-and-advocacy/publicuvalues/student-debt/

42% graduate with no debt and 23% with less than $20k. It’s about 80% that have less than $30k in student loans. 30k is definitely expensive, but manageable.

I am sorry, but your proof invalidates your argument. Look at the story we’re responding to - she had 5k in debt that spawned into multitudes due to her inability to pay it back as a result of living paycheck to paycheck. 20k or 30k is not a small amount of money for people living a minimum wage existence.

If you don’t pay your loan it goes up that’s not surprising. What is surprising is that she could get that loan in the first place. She could have bought lottery tickets with that loan and it would have the same effect, but people actually recognize that as stupid.

Did you read the article? Unexpected health complications with her partner used up all their money. The only stupid thing here is that a person working a full time job to afford healthcare and education realistically can’t do so.

deleted by creator

Hah. My partner’s Student loans are coming back this month. They’ll owe almost 500 dollars on an income driven plan that will (hopefully) pay it off in 2038 with PSLF. Or we can get it down to 300 dollars a month, and not pay it off until 2058.

This generation is truly fucked. We should burn some shit.

Not from the USA… what’s the interest rate on student loans? I mean, if you can afford a mortgage and to put money aside (article is about seniors, so not people purchasing a home now), how come you’re unable to reimburse your debt?

What makes you think they own a home? A ton of seniors live in rent controlled places and still barely get by.

The interest rate on my federal direct student loans is 6.8% on half of them (undergrad) and ~9% on the other half (graduate), iirc.

God damn fuck that’s ridiculous

Wait till you see how much we spend on healthcare.

Oh I know, per capita more than double the next first world nation and that doesn’t count private insurance.

It’s outrageous. My employer pays around $1,200 per month for my insurance. I pay another $400 per month. Then I pay for all medical services until I’ve spent $6,000 - on service - monthly premium payments don’t count. Then insurance covers 80% of medical expenses after that. Unless we’re talking about my kids. I have to spend $16,000 out of pocket before insurance starts to pay for their stuff.

afford a mortgage and to put money aside

Most of these people don’t own homes. That would be weird.

I have one question for americans, where does the college money go?

Is it to improve the colleges? Do college professors are paid extra well? To the college owners?

There’s a lot of really over paid administrators and they spend money on a lot of avnifg bullshit. Basically because the government stopped funding colleges directly and offers loans, the colleges just spend money to our compete each other and become “prestigious”. They’re all “non-profit” so they spend the money somehow and just increase their budgets constantly. If there’s any extra they build a new football stadium…

Without anyone to be accountable to, they just increase tuition, which people pay because there’s always loans. Then they always find something to spend the money on. Theres administrators making millions.