I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

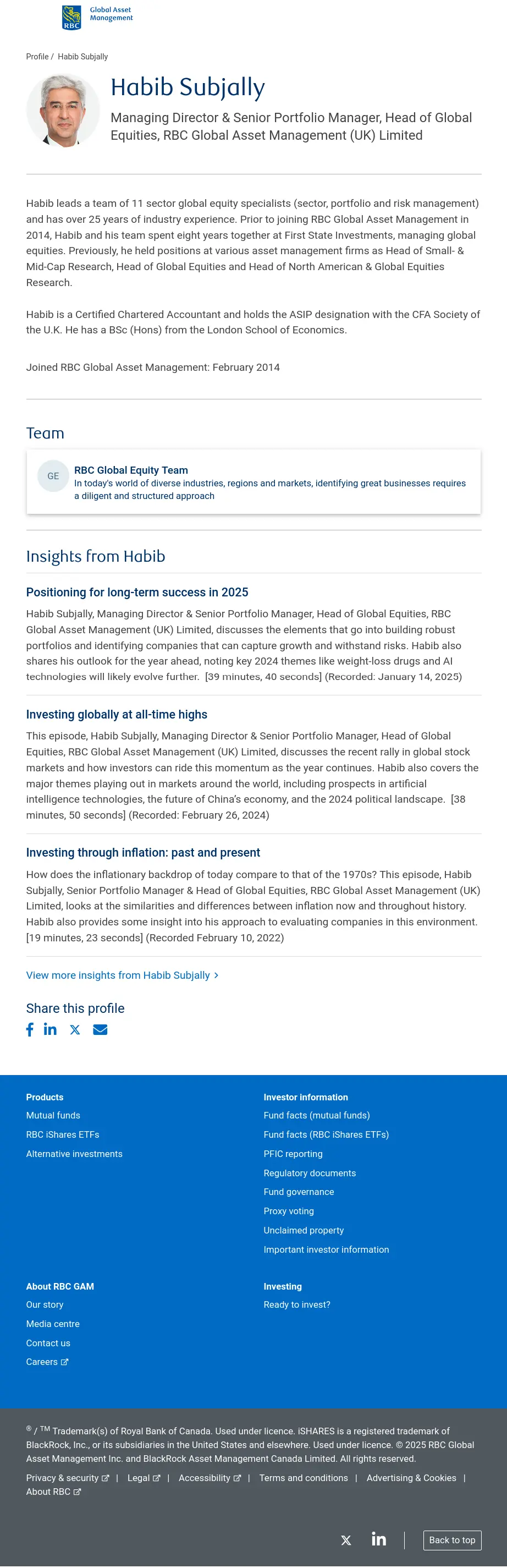

My fund is managed by that guy. I sold everything. Will reinvest in Europe.

Usually index funds outperform active investors.

https://en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

https://www.cnbc.com/2020/11/24/heres-when-active-mutual-funds-tend-to-outperform-index-funds.html

Define “active investors.”

Edit: how dare I ask a question!

Buying and selling stock based on short term value fluctuations.

Right, so that’s exactly what everyone in this conversation is recommending against, myself included. I’m paying his guy to identify and make good long-term investments, not make knee-jerk decisions because some asshole pooped his pants funny yesterday.

That is still considered active trading when someone is manually picking which stocks to buy. Historically, passive investing into index funds tends to have outperformed nearly everyone who does individual stock picking based on their own judgement.

Paying someone to manage your investments for you does not mean you’re not an “active” investor. An example of active vs passive investments would be that passive investments usually involve index funds… that is, funds that include virtually “all” stocks and closely resemble the overall makeup and performance of the market as a whole.

As opposed to “active” investments which, as just one example, could include using someone to manage your investments if they are picking individual stocks based on whatever their criteria are for what they think is a “good” investment.

Yes, that is exactly my point. Try re-reading the thread.

Monkeys throwing darts at a dart board would likely outperform your “guy.” But have fun with that.

OK buddy.